What is Dext?

Dext revolutionises your accounting workflow by making it effortless. Eliminate the manual work so you and your clients can reclaim valuable time and focus on what matters. By harnessing the power of accurate data extraction and practice efficiency insights, Dext empowers your firm with the best data, from submission to reconciliation.

What does it do?

Accurate, automated data extraction

Dext's award-winning data extraction reduces the errors you might make when manually entering the data yourself. You can also use Supplier Rules to extract and categorise the inputted data.

Multiple submission methods and integrations

Submit your client paperwork in a way that suits you. Snap through Mobile App, email in, or use our automated Invoice Fetch feature. With over 30 integrations, Dext is also the most widely integrated solution in the market.

Dashboards backed by actionable insight

Day-to-day dashboards allow you to drill down into data and optimise your firm’s bookkeeping efficiency. Get actionable insight into rich data and align client activity with your own KPIs.

Key Benefits

Less manual data entry

Take the pain out of bookkeeping by removing manual data entry from your workflow and get a better view of missing paperwork. Take that time back to concentrate on creating value for your client.

Better client relationships

Save time on data processing and reinvest that time into having better conversations with clients and meeting deadlines.

Instant access to work to be done

See what your team needs to action for their clients, where there’s paperwork missing, and where there’s room to automate. Discover a real-time view of work to be done, avoiding the rush to meet deadlines at the end of the month.

Cost (from)

£165/month

Free Practice Subscription

Trial

14 day free trial, fully functional, no credit/debit card required

Partner Program

Support Channels

Mobile Platforms

Accounting Platforms

Integrations

Amazon

ApprovalMax

Dropbox

eBay

Etsy

Google Drive

GoProposal

PayPal

Shopify

Stripe

Trustpilot

WooCommerce

Zapier

Geographies Served

Australia

Canada

France

Hong Kong

India

Ireland

New Zealand

South Africa

United Kingdom

USA

Industries

Refer a Friend, Get a Free Month with Dext

How To Get Rewarded For Referring Your Peers To Dext Refer an accountant or bookkeeper to Dext and when they sign up, you’ll both get a month free. Conditions apply: To be eligible you must be a Dext Partner who is an accountant or bookkeepers. You can refer other accountants or bookkeepers in practice not using Dext. They will be rewarded with a free month of Dext when they sign up (capped at £500 or equivalent in your local currency). We will reward you with a free month in return when they sign up to an annual plan (capped at £500 or equivalent in your local currency). Keep an eye out for more limited time referral offersI There is no limit to the number of referrals you can make. You will receive a free month for each referral that signs up. Full terms and conditions can be found here. To get a month free, simply refer a friend or peer working in an accounting or bookkeeping practice by completing the following steps: Navigate to the Manage menu in the Dext web application, click on My Profile and then Get a month free. Also available on the app. Enter the email address of the person you would like to refer and click send. We will send them the introductory email with a link to start a free trial. When the recipient signs up for an annual subscription to Dext then you’ll both be rewarded.

Read more

Multiple document collection methods with speedy data extraction

Automated transaction and publishing rules for repetitive suppliers and customers

Collection and processing of bank transactions and statements

Automatic reconciliation of transactions and attachment of matching paperwork

Mobile app for quick and simple receipt submission and expense management

Integrations with all major accounting software providers

Advanced automation and approvals for expense reports

In-depth bookkeeping efficiency dashboard

Add Documents

Advanced data collection

Expense and income data

Email-in

Mobile App

Supplier fetching

Manual upload

Bank data

Bank feeds

Bank statement extraction

Expenditure and income

Data extraction

Supplier rules

Customer rules

Item messaging

Automatic publishing to integration

Bank match

Paperwork match

Line item extraction

Purchase order matching

Expense Reports

Automatic submission

Automatic creation of expense reports

Approvals from web and mobile

Report creation by mobile

Categorisation

Income and expenditure

Automatic categorisation

Manual categorisation

Categorisation rules

VAT tracking

Data insights

Client-side

Identify within reconciled transactions what supporting documents are missing

Recognise which transactions lack supporting documents and are pending reconciliation.

Practice automation dashboard

Support

Around-the-clock human support

Self-guided training academy

Personalise onboarding

A dedicated Account Manager

Storage

At least 10 years of document storage

Unlimited storage

Cloud Storage: DropBox, Microsoft OneDrive and Google Drive

New Features and product Updates - Jan 2026

Dext - Free Guide Power Your 2026 Strategy

2025 Wrapped: A Year of Bigger Things

Autumn Budget 2025: Insights That Help You Stay Ahead

From Admin to Advisory: 5 ways to unlock growth with AI

What's Next at Dext

Dext - Global Partner Updates

Unlock the Future of Accounting: Key Insights from AI Innovators

Supercharge Your Bookkeeping: Insights for Autumn & Beyond

AI-Driven Workflows: Save Hours, Make Faster Decisions, Work Smarter

Introducing Vault for mobile

The ROI Blueprint

Dext update - AI-powered line item extraction

Introducing the Multi-Entity Dashboard by Dext

The Admin Tax - The cost of wasted potential for your clients business

The MTD IT Bootcamp - MTD IT

What’s your bigger thing?

Time for Dext: Mini-series - Time for optimisation

Dext The Ultimate MTD IT Toolkit

Dext - Fall in love with workflows

Watch our App of the Month - Getting Ready for MTD: Pricing Considerations & Workload Management

How Dext is redefining innovation through customer collaboration

Dext Tax Talk 2025 Mini-Series - Streamline HMRC enquiries with Dext: The ultimate solution for stress-free bookkeeping

MTD IT: Frequently Asked Questions

Getting ready for MTD: Pricing considerations and workload management

🚀 Big news from Dext! 🚀 - Integration of Dext Prepare, Precision, and Commerce

The next phase of the Dext evolution is here

Making Tax Digital for IT: Key Tools and Practical Insights

Fall in love with automation: Discover Dext features that truly optimise productivity and growth

Dext announces global Zoho Books integration

Why MDT IT is a great opportunity to win new clients

UK SMBs losing as much as £1.1bn per month from poor expense tracking

Dext renews Platinum Partnership with App Advisory Plus 2025

2024 at Dext: Innovation and features that made your life easier

Expanding your services: How to offer client advisory as a Bookkeeper or Accountant

5 ways to future-proof your business

Pricing strategies for Accountants and Bookkeepers in 2025

Dext Solo is now HMRC-recognised for MTD for Income Tax

How to answer critical questions sole traders have on the MTD ITSA 2026 deadline

What does the Autumn Budget 2024 mean for accountants and bookkeepers?

What does the Autumn Budget 2024 mean for accountants and bookkeepers?

The release round-up – Business Owners edition

The release round-up – October 2024

All You Need to Know About Sundry Expenses

Bookkeeper: Enhance Your Accuracy and Productivity with Dext

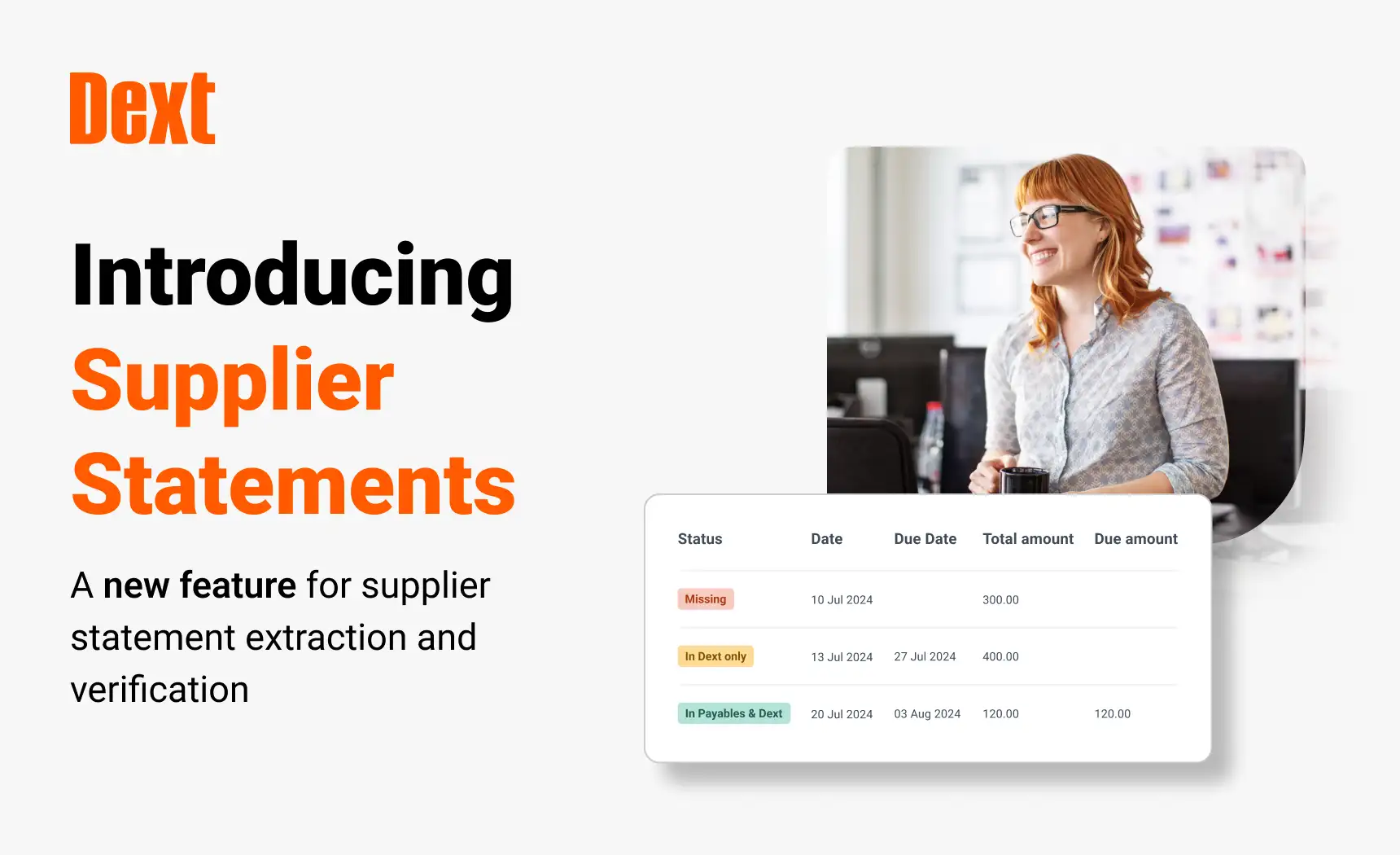

Supplier Statements – Dext’s new feature for supplier statement extraction and verification

How to Streamline Your Company’s Employee Expenses

Dext for Businesses: An Enhanced Experience with New Features

The Fastest Way to Upload Receipts and Invoices to Xero

5 Common Mistakes Caused by Manual Bookkeeping

The Fastest Way to Upload Receipts and Invoices to Xero

How to Accelerate Quickbooks Receipt Capture

Why Accounting Firms Are Turning to Dext for Growth and Efficiency

The Evolution of Dext

Cloud Technology in Bookkeeping by Dext

The Bookkeeper of the Future by Dext

Bas & Balances and Dext: Four Times More Clients and Better Life Quality

How Dext Helps Woodbridge Waterfields Expand its Services and Reach

Dext: Financial Management Guide for Hospitality Businesses

How To Optimise Your Hospitality Budget With Dext

Dext: Why Neglecting Bookkeeping Automation is Risky

Is being a digital firm the key to your success? App of the Month webinar with Dext

Dext announces the general availability of Dextension at Accountex London, 2024

Dext Transforms Accounting Processes for Maximum Efficiency

Double-Entry Bookkeeping Explained by Dext

Dext: Bookkeeping Automation Doesn’t Replace Bookkeepers – Here’s Why

The Ultimate Guide to Automated Bookkeeping Software by Dext

Visit the App Advisory Theatre at Accountex London! 15th-16th May 2024

Accountex London 2024 Scavenger Hunt

Dext: How Automation Facilitates Payments, Project Bidding and Cash Flow in Construction

Dext: How You Can Implement AI for Bookkeeping in 2024

Dext: Will AI Replace Accountants and Bookkeepers With Automation?

Dext Prepare: Why Accurate Bookkeeping Is a Foundation for Construction Success

Dext - Digital Transformation: How To Optimise Accounting Automation for Efficiency

Effortless Accounting: Why Digital Transformation Is Crucial from Dext

Dext Prepare releases milestone ‘Original Email Trail’ feature

Embracing Efficiency: Introducing the ‘Original Email Trail’ Feature by Dext

Dext: How Technology Elevates Construction Financial Management

Dext: Paul Aplin OBE reflects on the Spring Budget announcement

Dext participating in Developer Growth Program for Quickbooks integration

How Dext Prepare Builds Streamlined Accounting for the Construction Industry

Simplifying Accounting with Dext Prepare and QuickBooks

Dext renews Platinum partnership with App Advisory Plus

Bright/Shift Discovers the Bright Side of Accounting with Dext Prepare

2024 Accounting Trends: AI Takes the Lead by Dext

Training Accountants For the AI Era by Dext

Iron Lake Balls Utilises Dext Prepare for Ace Accounting

Dext part 2: Optimising accounting automation for efficiency

Dext part 1: Goodbye data entry. Hello! Effortless accounting

The Implications of AI on Data Privacy and Security by Dext

Dext: How AI Can Drive Environmental and Social Responsibility

Dext webinar series: Accounting Automation from getting started to flying high

New updates announced for Dext Solo

Mazars and Dext Prepare: A Strategic Approach to Global Efficiency

Top 5 Features in Dext Prepare You Probably Don’t Know About

Ohalo and Dext Prepare: Pioneering Efficient Data Management in the Digital Age

Gecko Bookkeeping: Cooking Up Success with Dext Prepare

Dext Prepare Takes TB Electrics From a Paper Trail to a Green Cloud Journey

BASIS PERIOD REFORM: All you need to know from Dext

Dext Strengthens Integration with Xero to Boost Productivity for Small Businesses

Sabby Gill Discusses Dext’s Jam-Packed Plan for the Future

Inform Accounting and Dext: Real-Time Data and Solutions to Streamline Accounting

From Paper to Pixels: LWA and TW Bowler’s Digital Transformation Journey with Dext Prepare

Unleash the Power of Automation in Your Business Accounting by Dext Prepare

A First Look at Our Long-Awaited Feature: Multi-Account Management

Why Quality Data Must Be at the Core of Your Firm’s Strategy by Dext

Jo Wood Virtual FD’s First Steps to Accounting Automation

Dext Prepare vs Dext Commerce: Which One Does My Business Need?

Accounting for Small Business

Digital Transformation and the Future of Accounting

How Accounting Automation Empowers Businesses Owners

OnPoint Accounting Group uses Dext Prepare to increase practice efficiency

Smart Tech for Smart Businesses: Reclaim Your Evenings with Dext Prepare

Business Expense Management On The Go

New from Dext: Multi-account Management

Europe’s leading software investor Hg acquires major shareholding in Dext

When and How should you use Automatic Publishing in Dext

Dext is releasing an end-to-end MTD ITSA solution for accountants and bookkeepers

Some details on this page are subject to change. If you see something wrong please contact us here.

Latest news, events, and updates on all things App related, plus useful advice on App advisory - so you know you are ahead of the game.